what house can i afford on 700k a year

How much should you be spending on a mortgage. Ad Knowing How Much You Can Afford Is The First Step Towards Homeownership.

Rising Mortgage Rates Reduced Home Purchase Power By 6 Redfin National Mortgage News

To afford a house that costs 700000 with a down payment of 140000 youd need to earn 104450 per year before tax.

. When you earn a 70k salary your gross monthly income will be around 5833. 415 49 votes You need to make 215337 a year to afford a 700k mortgage. You can probably do that and still afford the 700k house.

This means you can give up to 15000 to as many people as you want during the coming year without any of it being subject to a gift tax Borrowers with a low DTI excellent credit score and. 55 62 votes You need to make 215337 a year to afford a 700k mortgage. That is because several variables go into determining your.

Can I buy a house making 40k a year. We base the income you need on a 700k mortgage on a payment that is 24 of your monthly income. Whats the most expensive house you can afford with an income of 100000.

Before taxes and other withholdings the average person who makes around 70000 a year will take home around 5800 each month. How much house can I afford making 100k a year. Take a homebuyer who makes 40000 a year.

The monthly mortgage payment. Assuming a 4 mortgage rate and a 30000. Monthly mortgage payment of 1450 would fall within.

According to Brown you should spend between 28 to 36 of your take-home income on your housing payment. The maximum amount for monthly mortgage-related payments at 28 of gross income is 933. With an income of 70k your monthly gross income pre-tax is about 5833.

That is because several variables go into determining your home buying. When attempting to determine how much mortgage you can afford a general guideline is to multiply your income by at least 25 or 3 to. 100K salary and great credit buys a home above 700K.

Someone who earns 70000 a year will make about 5800 a month before taxes. We base the income you need on a 700k mortgage on a payment that is 24 of. In general an individual who earns 70000 might afford a home worth anywhere from 200000 to nearly 500000.

Your monthly mortgage payment including HOA fees taxes etc should not be more than. Learn how to calculate how much house you can afford before hitting that open house or applying for a mortgage. You may be able to.

According to Brown you should spend between 28 to 36 of your take-home. If you make 70K a year you can likely afford a house payment between 1500 and 2000 a month depending on your personal finances. If you make 120000 per year you can afford a house anywhere from 300000 to 480000.

How much house can I afford if I make 68000 a year. How much should you be spending on a mortgage. In general an individual who earns 70000 might afford a home worth anywhere from 200000 to nearly 500000.

Your monthly mortgage payments should not be higher than 28 of this value or 1633. The above table gives an estimate of how much house individuals with a 100k annual income in Texas can afford. Spending 25 of 5800 on housing would mean a total monthly.

How Much Do You Need To Make Annually To Afford A 700k House Quora

Should I Buy A 700k House Can I Afford It

Physician Mortgage How Much Can I Afford Financial Residency

23008 Anna Ln Frankfort Il 60423 Mls 11480504 Redfin

How Much House Can I Afford Smartasset

Here S How To Figure Out How Much Home You Can Afford

Income Needed For A 700k Mortgage Think Real State

How Much Down Payment For A 700k House Top Sellers 54 Off Www Peopletray Com

Pyramid Shows 36 Million Households Cannot Afford A 150 000 Home Eye On Housing

/story/featureImage/d38fbad6d0c7a19ea31cc9c4de4e70f29632.jpg)

Can I Afford A 780k House On A 125k Salary

Simple Home Affordability Calculator How Much Home Can You Afford

List Of Gilded Age Mansions Wikiwand

Looking To Buy A Home For 1 2 Million Here S What You Can Expect To Find The Washington Post

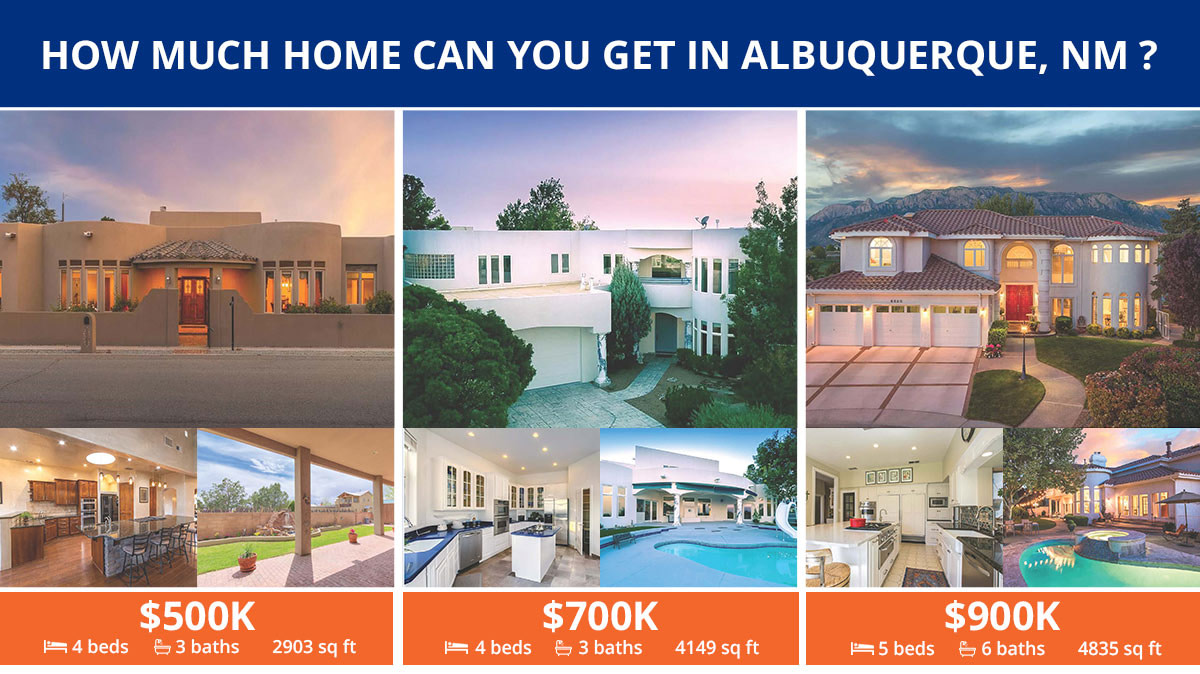

Relocating To Albuquerque From The Bay Area Cost Of Living Comparisons

How Much House Can You Afford Based On Income Student Money Adviser

How Much House Can You Afford Lyon Financial Planning

21 1 Million Households Cannot Afford A 100 000 Home